Automation Surge

Remember when automation was just a buzzword? Well, it’s no longer a futuristic fantasy. In fact, tech stocks are betting their future on it, and the stakes are higher than ever.

By Dylan Cooper

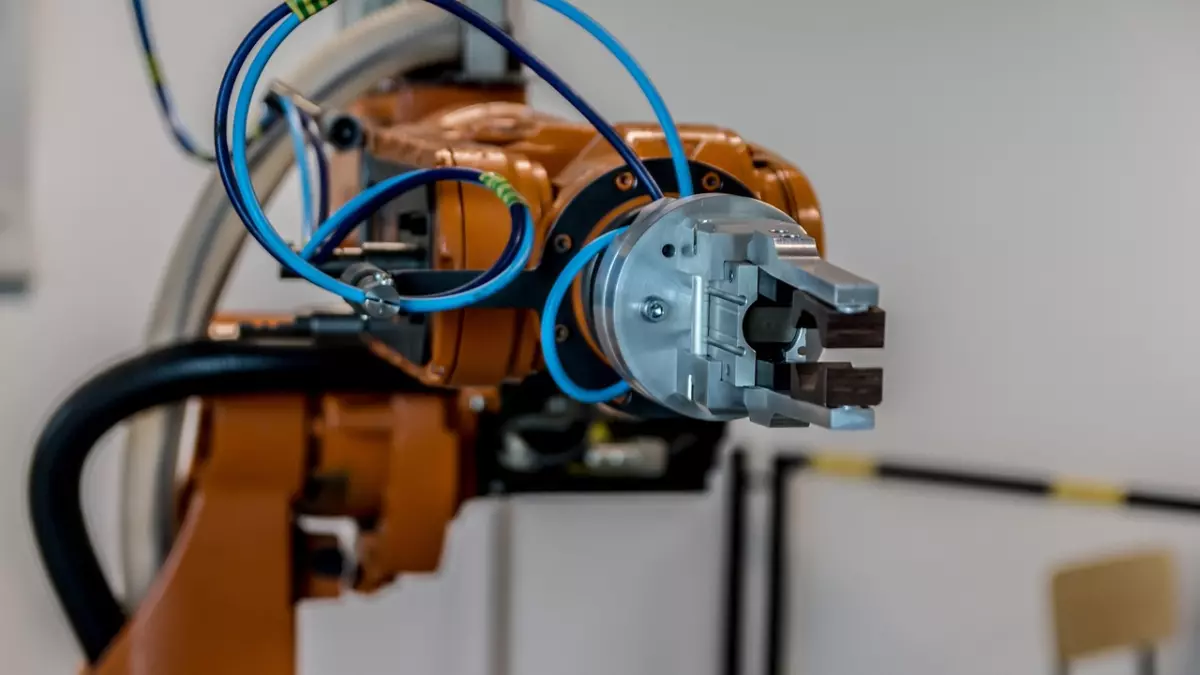

Let’s rewind a bit. There was a time when automation was limited to factories and assembly lines. It was all about machines doing repetitive tasks that humans found boring or too dangerous. Fast forward to today, and automation has evolved into something far more sophisticated, thanks to artificial intelligence (AI). We’re not just talking about robots on the factory floor anymore; we’re talking about AI-powered systems that can think, learn, and adapt. And guess what? Tech companies have taken notice.

In the early 2000s, automation was still in its infancy, and tech stocks were focused on other trends like the rise of the internet and mobile technology. But as AI started to mature, so did the potential for automation. Companies like Google, Microsoft, and Amazon began pouring billions into AI research, and it wasn’t long before automation became a key focus for the tech industry. Today, AI-powered automation is not just a trend; it’s a full-blown revolution, and tech stocks are riding the wave.

Why Tech Companies Are All In

So, why are tech companies betting big on AI-powered automation? The answer is simple: efficiency and scalability. Automation allows companies to streamline their operations, reduce costs, and scale their services without needing to hire more people. For tech giants, this means they can offer more services to more customers at a fraction of the cost. And for investors, this translates into higher profit margins and, ultimately, higher stock prices.

Take Amazon, for example. The company has been using AI-powered automation in its warehouses for years, allowing it to process and ship millions of orders with minimal human intervention. This has not only reduced costs but also allowed Amazon to scale its operations globally. As a result, Amazon’s stock has skyrocketed, making it one of the most valuable companies in the world.

But it’s not just the big players that are benefiting from AI-powered automation. Smaller tech companies are also getting in on the action. Startups specializing in AI and automation are attracting massive investments, and many of them are going public, offering investors a chance to get in on the ground floor of the next big thing in tech.

The Financial Metrics You Need to Watch

When analyzing tech stocks that are heavily invested in AI-powered automation, there are a few key financial metrics to keep an eye on. First, look at revenue growth. Companies that are successfully implementing automation should see a significant increase in revenue as they’re able to scale their operations more efficiently. Second, pay attention to profit margins. Automation should lead to cost savings, which should, in turn, boost profit margins. Finally, keep an eye on research and development (R&D) spending. Companies that are serious about AI-powered automation are likely to be investing heavily in R&D to stay ahead of the competition.

For example, Microsoft has been investing heavily in AI and automation, and it shows in their financials. The company’s revenue has been steadily increasing, and its profit margins remain strong, thanks in part to its AI-powered cloud services. Similarly, Google’s parent company, Alphabet, has been pouring billions into AI research, and it’s paying off. The company’s AI-powered advertising platform has helped drive significant revenue growth, making Alphabet one of the top-performing tech stocks in recent years.

Market Trends: What’s Next?

Looking ahead, it’s clear that AI-powered automation is here to stay, and tech stocks are likely to continue benefiting from this trend. But what’s next? One area to watch is the rise of autonomous systems. We’re already seeing AI-powered automation in industries like transportation, with companies like Tesla and Waymo leading the charge in self-driving cars. As these technologies mature, they could open up new markets and create even more opportunities for tech companies and investors alike.

Another trend to watch is the increasing use of AI-powered automation in healthcare. Companies like IBM and Google are already using AI to analyze medical data and assist in diagnostics, and this trend is only expected to grow. As healthcare becomes more automated, it could lead to significant cost savings and improved patient outcomes, making it a win-win for both tech companies and the healthcare industry.

Finally, keep an eye on regulatory changes. As AI-powered automation becomes more widespread, governments are likely to step in with new regulations to ensure that these technologies are used responsibly. While this could create some uncertainty for tech stocks in the short term, it’s unlikely to derail the long-term growth of AI-powered automation.

History Repeating Itself?

In many ways, the rise of AI-powered automation mirrors the early days of the internet. Just as the internet revolutionized the way we live and work, AI-powered automation is poised to do the same. And just like in the early days of the internet, tech companies that embrace this new technology are likely to come out on top. So, if you’re looking to invest in tech stocks, keep an eye on those that are leading the charge in AI-powered automation. It could be the next big thing.